Quick Ratio:

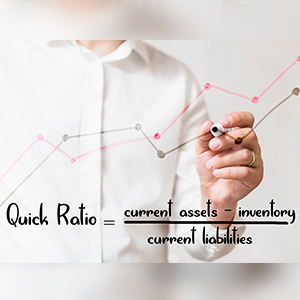

The Quick Ratio represents an indication for the company which heavily emphasizes over its short-term liquidity and its potential to fulfill the temporary obligations with assets having maximum liquidity in particular. Therefore, it embarks on excluding inventories from the current assets and is evaluated by this universal formula –

Quick ratio = (Current Assets – Inventories) Divided By Current Liabilities:

Quite miraculously, it targets the dollar amount of assets that have maximum liquidity and are available for each dollar of the current liabilities. Therefore, it technically means that a quick ratio of 1.5 indicates that a company has to offer $1.5 for its liquid assets that are covering up $1 of each debt accordingly.

Furthermore, experts reckon that companies with the higher amount of quick ratio are having enough potential to cover up their short and long-term liabilities. In other words, it’s the company’s liquidity position which is considered as something essential in the market.

Facts:

In contrast with the current ratio, the quick ratio follows a stricter set of rules by eradicating inventories from the column of current assets. This kind of ratio is a reflection of its name tag, as it supports and encourages organizations to open up to ‘cash’ as well as ‘marketing securities’ that are presumed as the quickest sources of cash in the market. However, inventories can take endless time duration to be converted into cash and not even in their original prices.

Example:

Assume that a company is showcasing the following current assets on its balance-sheet.

- Cash = $5 Million

- Marketable Securities = $10 Million

- Accounts Receivable = $15 Million

- Inventories = $20 Million

The equation is balanced by exhibiting a total of $20 Million of Liabilities. Hence, the quick ratio in this scenario is ‘1.5’ along with the current ratio of ‘2.5’ respectively.