What is Cost of Capital:

The Weighted Average Cost of Capital is a measurement of a company’s overall cost of capital, which includes the most important categories of the equity to weigh them through a specific equation. This statistical logic has helped numerous businesses worldwide and is considered as the most legitimate act of calculating the cost of capital in finance today.

The experts recommend adding almost all capital sources to maintain accuracy within the records and reliability in terms of getting the right value. What’s preferably important for calculating weighted average cost of capital?

- Common stock

- Preferred stock

- Bonds

- Liabilities

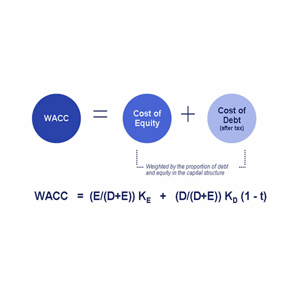

Lets understand the fact that a company exhibits two primary sources when it comes to its financing department, ‘equity’ as well as ‘debt’, therefore, the main objective behind using the weighted average cost of capital is to boost the funds by balancing the equation of these sources.

According to finance experts, the easiest way to find the WACC is by multiplying the cost belonging to the capital sources, both for debt and equity, however, by maintaining relevance in weight and putting in products together to evaluate the right value ofthis financial equation.

Formula of WACC = * Re + * Rd * (1 – Tc)

Mentioned previously, the formula depicts the aspects related to debts as well as equity. Here ‘Re’ is the cost of equity and ‘Rd’ is the cost of debt accordingly. Moreover, ‘Tc’ stands for ‘corporate tax rate’, which is the most essential aspect in order to calculate the leftover of the capital amount.

The Weighted Average Cost of Capital helps in finding the overall return of the company under one section. It is being largely used by company directors on internal basis to evaluate the best ways to expand the opportunities for future endeavors.