Liquidity:

Liquidity is defined as an extent to which assets as well as marketable securities are bought and even sold back in the markets without manipulating their original price. It’s a high-end trading activity which exhibits its occurrence in manufacturing companies that are willing to spend a great chunk of money over the inventory.

Furthermore, it is worth mentioning that assets with the tendency of getting bought and sold in the markets with a remarkable speed are labelled as ‘liquid assets’ in accountancy. It also focuses on the phenomenon of converting assets into cash in an efficient manner which is considered as the process of ‘marketability’.

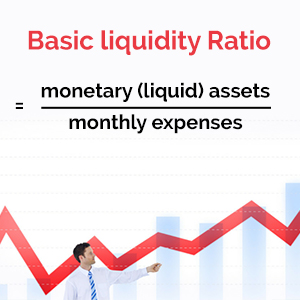

Liquidity Ratio:

Another paradigm in the world of accountancy, with its immense use in evaluating a company’s overall potential to pay off its short-term debt and obligations that are associated with this manner. Therefore, it is important to understand that having a higher value of ratio is an indication towards a larger margin of safety that the company showcases upon paying its short-term debts in the market.

The liquidity ratio bounces into action when creditors are on the verge to seek payments whereas the owners decide to turn short-term assets into cash to fulfill the desired requirement of the company. Most experts recommend checking on company’s ‘Liquidity Ratio’ in order to presume their financial standings in the market.

Additional Information:

Since it covers up the most important aspects of paying off our debts and reducing the risk of getting tangled with obligation, the liquidity ratio supports various other contents, such as:

- Quick Ratio

- Cash Ratio

- Cash Conversion Cycle